Understanding Standard Settlement Instructions (SSI)

|

| Demystifying Standard Settlement Instructions for Seamless Payments |

Understanding Standard Settlement Instructions (SSI) is crucial for efficient and accurate payment processing. SSI provides a standardized format for communicating the necessary details for settling transactions between financial institutions. Key components of SSIs include information about the beneficiary bank, the correspondent bank, the account numbers, and the currency. Decoding and interpreting SSIs requires knowledge of the specific format and terminology used. Implementing SSIs effectively involves setting up and maintaining accurate and up-to-date instructions for each counterparty. Automation and technology solutions can streamline the management of SSIs and reduce the risk of errors. By understanding and utilizing SSIs, businesses can ensure seamless payments and mitigate potential risks in financial transactions.

Overview of Standard Settlement Instructions

|

| Demystifying Standard Settlement Instructions for Seamless Payments |

Standard Settlement Instructions (SSI) provide a standardized format for communicating the necessary details for settling transactions between financial institutions. The key components of SSIs include information about the beneficiary bank, the correspondent bank, the account numbers, and the currency. Decoding and interpreting SSIs requires knowledge of the specific format and terminology used. Implementing SSIs effectively involves setting up and maintaining accurate and up-to-date instructions for each counterparty. Automation and technology solutions can streamline the management of SSIs and reduce the risk of errors, ensuring seamless payments and mitigating potential risks in financial transactions.

Importance of Standard Settlement Instructions in payments

|

| Demystifying Standard Settlement Instructions for Seamless Payments |

Standard Settlement Instructions (SSI) play a crucial role in ensuring smooth and efficient payment transactions. By providing a standardized format for communicating transaction details between financial institutions, SSIs minimize the risk of errors and delays. This promotes accurate and timely settlement of funds, enhancing the overall efficiency of the payment process. With the increasing complexity of global financial transactions, the importance of SSIs in payments cannot be overstated. Financial institutions must prioritize the implementation and maintenance of accurate SSIs to facilitate seamless payments and mitigate potential risks.

Components of Standard Settlement Instructions

|

| Demystifying Standard Settlement Instructions for Seamless Payments |

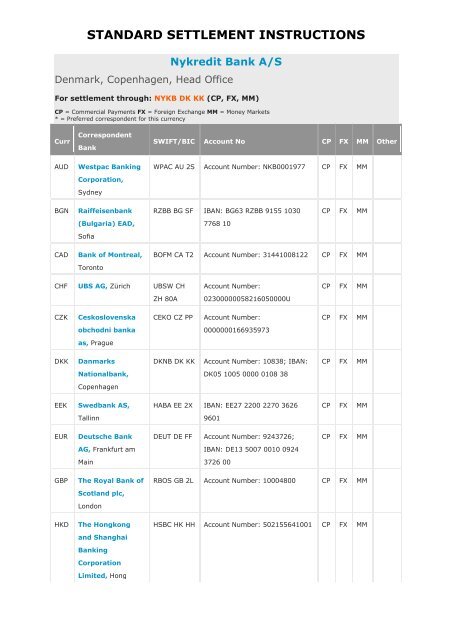

Standard Settlement Instructions (SSI) consist of key components that provide vital information for payment transactions. These components include bank details such as the beneficiary bank's name, account number, and branch code, as well as the correspondent bank details for international payments. Additionally, SSIs may include information about the currency, settlement instructions, payment routing details, and any additional requirements specific to the payment transaction. Financial institutions must ensure the accuracy and completeness of these components to facilitate smooth and efficient payment processing.

Key components of Standard Settlement Instructions

|

| Demystifying Standard Settlement Instructions for Seamless Payments |

The key components of Standard Settlement Instructions (SSI) include bank details such as the beneficiary bank's name, account number, and branch code, as well as correspondent bank details for international payments. SSIs also specify the currency, settlement instructions, payment routing details, and any additional requirements specific to the payment transaction. These components are crucial for accurate and seamless payment processing in the financial industry. Financial institutions must ensure the accuracy and completeness of SSIs to facilitate smooth and efficient payment transactions.

How to decode and interpret Standard Settlement Instructions

|

| Demystifying Standard Settlement Instructions for Seamless Payments |

How to decode and interpret Standard Settlement Instructions

Decoding and interpreting Standard Settlement Instructions (SSIs) can seem daunting, but with a systematic approach, it becomes manageable. Here are some steps to help you navigate SSIs effectively:

- Familiarize yourself with the SSI format: Understand the structure and layout of SSIs to quickly locate and interpret the relevant information.

- Identify the key components: Focus on crucial elements such as bank details, including beneficiary bank names, account numbers, and branch codes.

- Pay attention to currency and settlement instructions: Determine the currency involved in the payment and the specific settlement instructions provided.

- Understand payment routing details: Take note of any correspondent bank details for international payments, ensuring the correct intermediary banks are utilized.

- Note any additional requirements: SSIs sometimes include specific instructions or requirements unique to the payment transaction. These need to be comprehended and followed accurately.

By following these steps, you can effectively decode and interpret SSIs, ensuring seamless and error-free payment processing.

Benefits of Standard Settlement Instructions

Standard Settlement Instructions (SSIs) offer several benefits for seamless payment processing. Firstly, they enhance efficiency and accuracy by providing standardized instructions for payment transactions. With SSIs, there is a reduced risk of errors, delays, and miscommunication. Additionally, SSIs help minimize operational costs by streamlining the payment process and eliminating the need for manual intervention. They also contribute to risk reduction by ensuring compliance with regulatory requirements and minimizing the potential for fraud. Overall, SSIs play a crucial role in facilitating smooth and secure payments for businesses and financial institutions.

Efficiency and accuracy in payments

Efficiency and accuracy are crucial in payment processing to ensure seamless transactions. To achieve this, you should automate payment systems and utilize technology for faster and more accurate processing. Implementing robust monitoring and validation tools can help identify and resolve any discrepancies promptly. Additionally, regular reconciliation of payment records and timely communication with the relevant parties can further enhance efficiency and accuracy. By prioritizing these practices, you can streamline your payment operations and reduce the risk of errors or delays, ultimately improving overall efficiency and accuracy in payments.

Reduction of risks and errors in transactions

By implementing Standard Settlement Instructions (SSI) in payment processing, businesses can significantly reduce risks and errors in transactions. SSIs provide clear guidelines and instructions for parties involved, ensuring that payments are processed accurately and efficiently. With consistent and standardized instructions, the chances of mistakes or misinterpretations are minimized, leading to smoother transactions and fewer disputes. This reduction in risks and errors not only saves time and resources but also enhances the overall payment experience for all parties involved.

Common Challenges with Standard Settlement Instructions

Common Challenges with Standard Settlement Instructions

While Standard Settlement Instructions (SSIs) play a crucial role in streamlining payment processes, there are some common challenges that businesses may face when dealing with SSIs. One major challenge is the presence of outdated or incorrect SSIs, which can lead to payment delays and errors. Another challenge is managing multiple SSIs for different counterparties, as each counterparty may have their own unique instructions. To address these challenges, it is important for businesses to regularly review and update their SSIs, and consider implementing automation and technology solutions for efficient SSI management.

Issues with outdated or incorrect SSIs

Issues with outdated or incorrect SSIs can cause significant problems in payment processes. They can lead to delays and errors in transactions, resulting in potential financial losses for businesses. To address this challenge, it is crucial for businesses to regularly review and update their SSIs. This includes staying informed about changes in counterparties' banking information and ensuring that the correct SSIs are used for each transaction. Implementing automated systems and technology solutions can also help streamline the process and minimize the risk of using outdated or incorrect SSIs.

Managing multiple SSIs for different counterparties

Managing multiple SSIs for different counterparties can be a complex task, but there are strategies that can help streamline the process. One approach is to create a centralized database or system to store and manage all SSIs. This allows for easy access and updates when counterparties change their banking information. Additionally, regularly reviewing and confirming SSIs with counterparties can help ensure accuracy and minimize errors. It is also important to communicate effectively with internal teams and counterparties to ensure everyone is using the correct SSIs for each transaction. By implementing these practices, businesses can more efficiently manage multiple SSIs and reduce the risk of errors in payment processes.

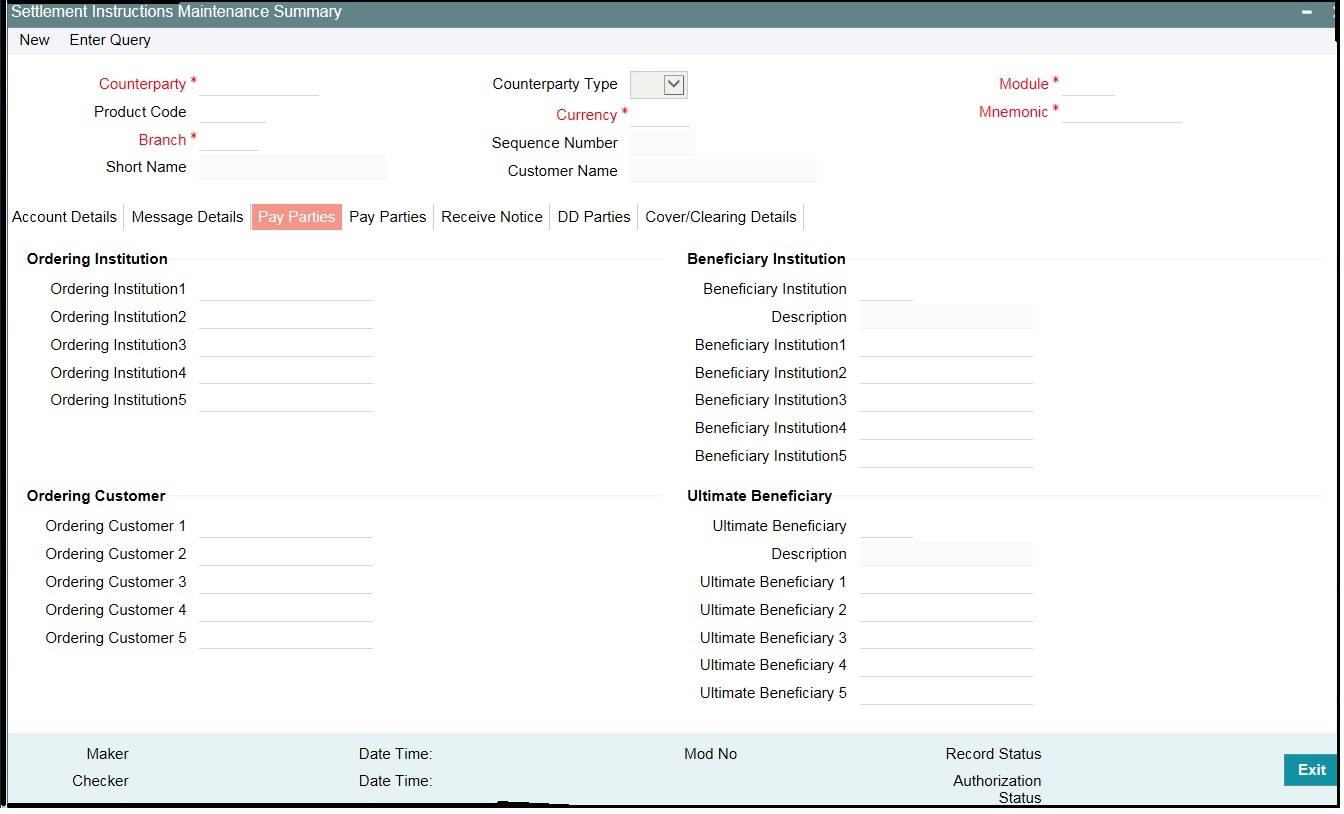

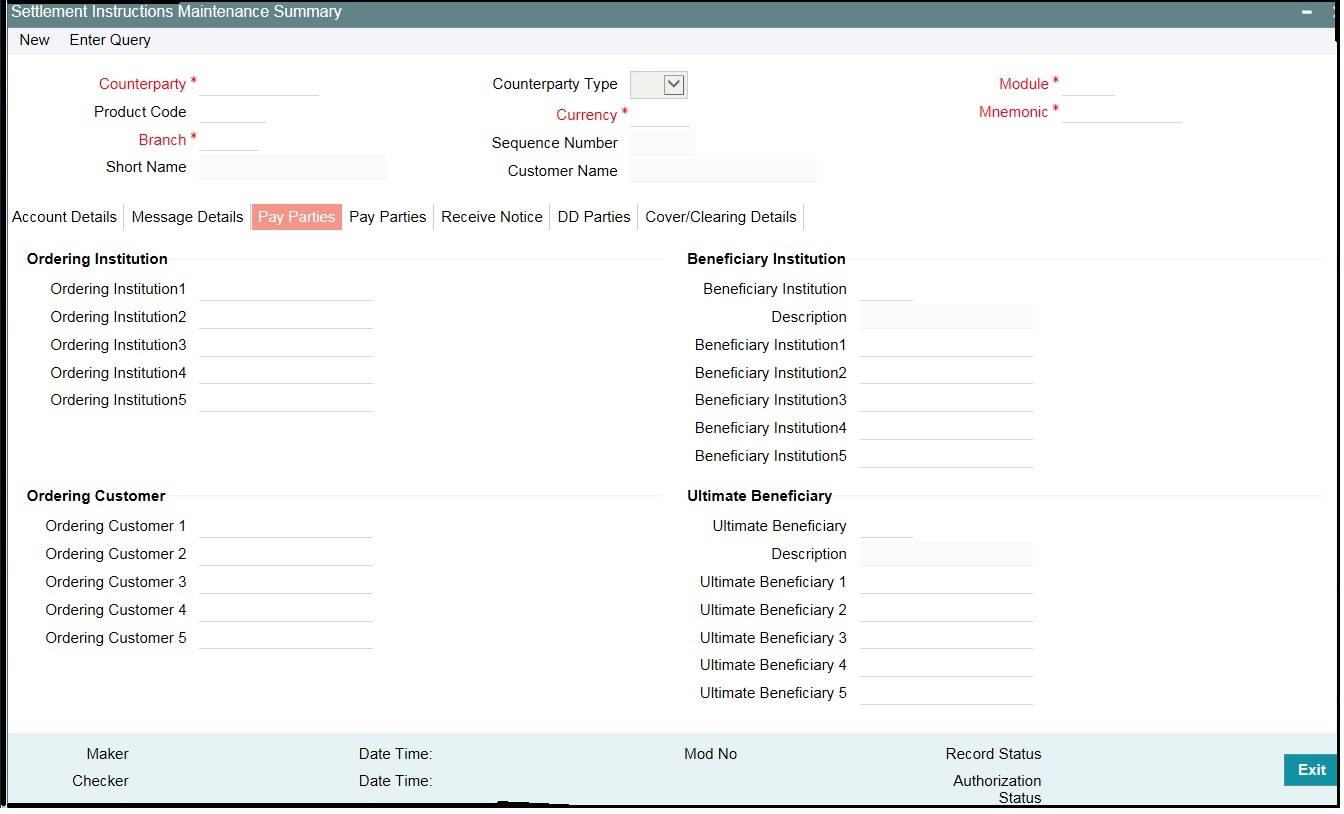

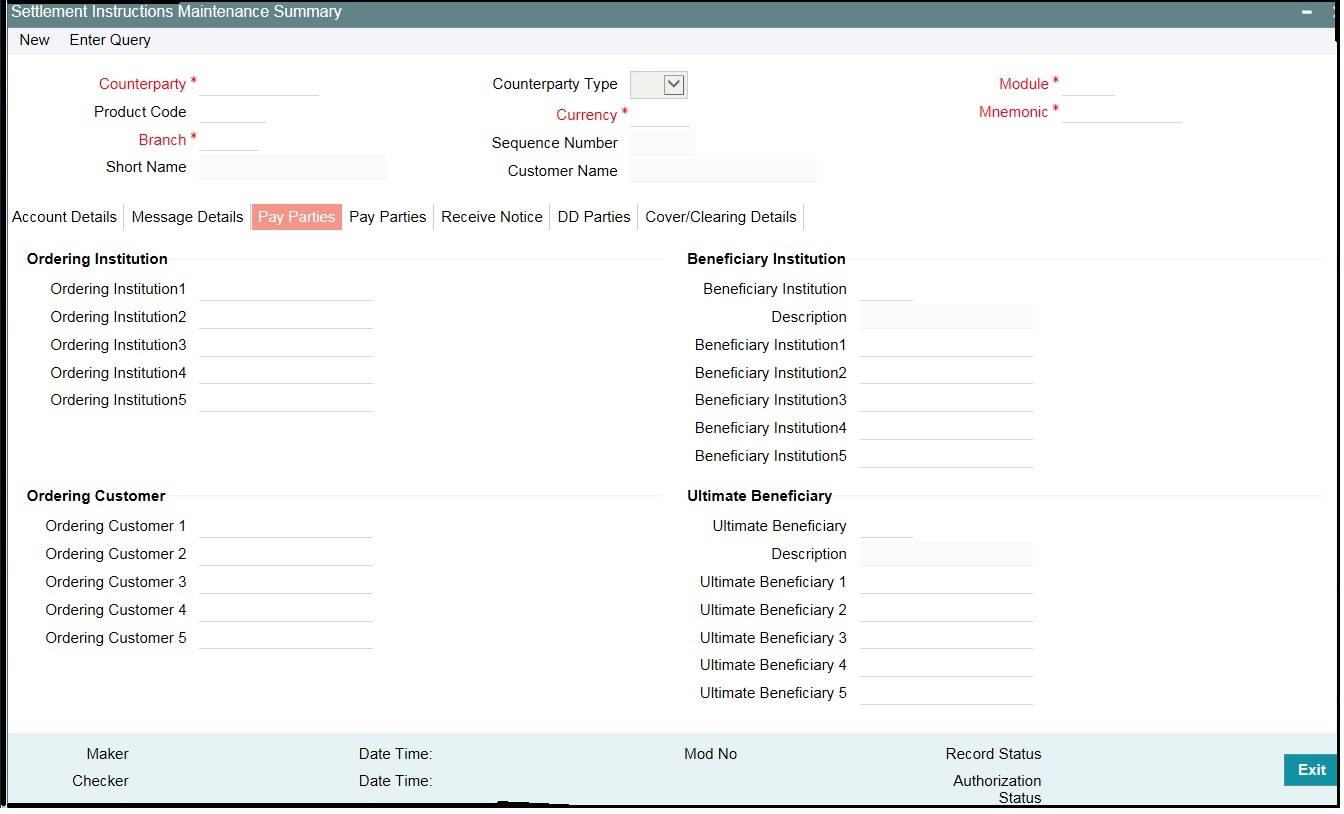

Implementing Standard Settlement Instructions

Implementing Standard Settlement Instructions

To effectively implement Standard Settlement Instructions (SSI), it is crucial to follow best practices and utilize automation and technology solutions.

- Setting up SSIs: Establish a centralized database or system to manage SSIs for different counterparties. Regularly review and confirm SSIs with counterparties to ensure accuracy.

- Maintaining SSIs: Keep SSIs up to date by promptly updating any changes in counterparties' banking information. Communicate effectively with internal teams and counterparties to ensure everyone is using the correct SSIs.

- Automation and technology: Implement SSI management systems or software that automate the process of retrieving and updating SSIs. This reduces manual errors and saves time.

By following these best practices and utilizing automation, businesses can streamline the implementation of SSIs and ensure seamless and accurate payment processes.

Best practices for setting up and maintaining SSIs

Regularly review and confirm SSIs with counterparties to ensure accuracy. Promptly update any changes in counterparties' banking information to keep SSIs up to date. Implement SSI management systems or software that automate the process of retrieving and updating SSIs. Communicate effectively with internal teams and counterparties to ensure everyone is using the correct SSIs. By following these best practices, businesses can streamline the implementation of SSIs and ensure seamless and accurate payment processes.

Automation and technology solutions for SSI management

Automation and technology solutions play a crucial role in the management of Standard Settlement Instructions (SSIs). By implementing automated systems and software, businesses can simplify the process of retrieving and updating SSIs, saving time and reducing the risk of errors. These solutions ensure that the most up-to-date SSIs are readily accessible and can be shared seamlessly with internal teams and counterparties. Automation also enables the prompt identification and resolution of any discrepancies or changes in counterparties' banking information, ensuring accurate and efficient payment processes. With these solutions in place, businesses can streamline SSI management and enhance their overall payment operations.