Understanding Mortgage Rates

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

Understanding how mortgage rates work can help you make informed decisions when it comes to purchasing a home or refinancing an existing mortgage.

Understanding how mortgage rates work

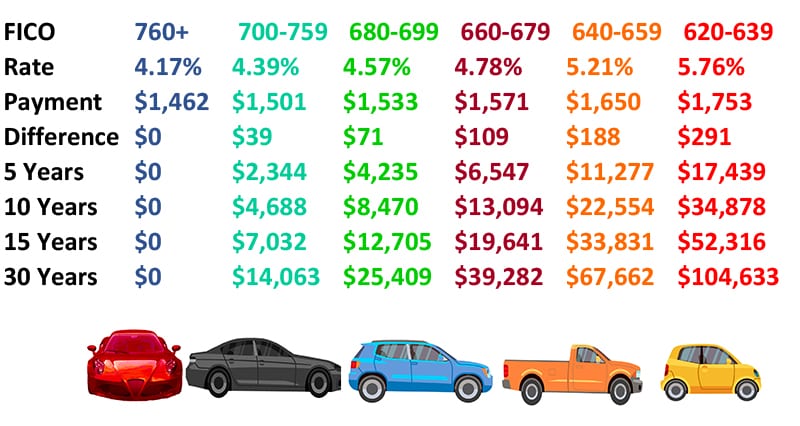

Mortgage rates refer to the interest charged on a home loan and can vary based on several factors, including the borrower's credit score, economic conditions, and the type of mortgage. Lenders determine mortgage rates based on their assessment of the borrower's risk. Generally, a higher credit score and a stable economy can result in lower rates. It's important to understand how mortgage rates work to make informed decisions and potentially save thousands of dollars over the life of a loan.

Factors that influence mortgage rates

There are several factors that influence mortgage rates, including the borrower's credit score, the overall economic conditions, and the type of mortgage. Lenders assess the borrower's creditworthiness and determine the level of risk involved. Higher credit scores typically result in lower mortgage rates, as lenders view these borrowers as less risky. Economic conditions, such as inflation and the Federal Reserve's monetary policies, also play a role in mortgage rate fluctuations. Additionally, the type of mortgage, such as fixed-rate or adjustable-rate, can impact the interest rate.

Types of Mortgage Rates

Fixed-rate mortgages explained

A fixed-rate mortgage is a type of mortgage where the interest rate remains the same for the entire loan term, usually 15 or 30 years, providing borrowers with the security of consistent monthly payments. It is a popular option for those who prefer predictable payments and want to lock in a low-interest rate.

Adjustable-rate mortgages demystified

In contrast to fixed-rate mortgages, adjustable-rate mortgages (ARMs) have interest rates that can fluctuate over time. The initial rate is usually lower than that of a fixed-rate mortgage, making the loan more affordable in the beginning. However, the rate can adjust periodically based on financial market conditions, potentially resulting in higher payments in the future. ARMs are suitable for borrowers who plan to sell or refinance their homes within a few years.

Fixed-rate mortgages explained

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg) |

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

Fixed-rate mortgages are a popular option for those seeking stability in their monthly payments. With a fixed-rate mortgage, the interest rate remains the same throughout the entire loan term, whether it's 15 or 30 years. This means borrowers can accurately predict and plan for their mortgage payments without worrying about fluctuations in interest rates. It provides peace of mind and financial security, making it an attractive choice for many homebuyers.

Adjustable-rate mortgages demystified

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg) |

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

An adjustable-rate mortgage (ARM) is a type of mortgage where the interest rate fluctuates periodically based on market conditions. Unlike a fixed-rate mortgage, the rate on an ARM adjusts periodically, typically every one, three, five, or seven years. The adjustments are based on an index, such as the Treasury bill rate or the London Interbank Offered Rate (LIBOR), plus a margin determined by the lender. ARMs often start with a lower interest rate than fixed-rate mortgages, making them appealing to some borrowers. However, borrowers should carefully consider their finances and the potential for rate increases before choosing an ARM.

Factors Affecting Mortgage Rates

The interest rates on mortgages are influenced by various factors that borrowers need to be aware of. Some key factors that affect mortgage rates include credit scores, economic conditions, and loan duration. Borrowers with higher credit scores tend to qualify for lower rates, while economic factors such as inflation and market conditions can cause rates to fluctuate. Additionally, the duration of the loan can also impact the interest rate, with longer-term loans often having higher rates. Understanding these factors can help borrowers make informed decisions when it comes to their mortgage rates.

Credit score's impact on mortgage rates

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

A borrower's credit score plays a significant role in determining their mortgage interest rate. Lenders consider credit scores as an indication of a borrower's creditworthiness. Higher credit scores generally result in lower interest rates, while lower credit scores may lead to higher rates. It is crucial for borrowers to maintain a good credit score by paying bills on time, keeping credit card balances low, and avoiding new credit applications before applying for a mortgage. Taking steps to improve credit scores can potentially save borrowers thousands of dollars over the life of their mortgage.

Economic conditions and mortgage rate fluctuations

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

Economic conditions play a crucial role in mortgage rate fluctuations. When the economy is strong and interest rates are low, mortgage rates tend to be lower. However, during periods of economic uncertainty or inflationary pressures, mortgage rates may rise. Keeping an eye on economic indicators such as GDP growth, unemployment rates, and inflation can provide insight into the direction of mortgage rates. Borrowers can take advantage of lower rates by timing their mortgage applications during favorable economic conditions. Monitoring economic trends and working with a knowledgeable lender can help borrowers secure the best mortgage rates.

Tips for Securing the Best Mortgage Rate

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

Improving your credit score is crucial when it comes to securing the best mortgage rate, as lenders offer lower rates to borrowers with higher credit scores. Comparison shopping is another effective tool, allowing you to explore different lenders and their rates to find the most favorable terms. Negotiating with lenders can also lead to lower rates, so don't be afraid to ask for better terms. By following these tips and leveraging your credit score, you can increase your chances of securing the best mortgage rate possible.

Improving credit score to get better rates

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

Improving your credit score is crucial when it comes to securing the best mortgage rate. Prioritize paying bills on time, paying down debt, and avoiding new credit applications to boost your score. Regularly checking your credit report for errors and disputing any inaccuracies can also help. Aim for a credit score of 740 or higher to increase your chances of qualifying for the lowest interest rates available.

Comparison shopping for the best mortgage rates

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

When it comes to securing the best mortgage rate, comparison shopping is key. Start by researching different lenders and their offers. Compare interest rates, fees, and terms to find the most favorable option. Don't hesitate to negotiate with lenders to try and get even better rates. Keep in mind that the lowest rate may not always be the best option, so consider the overall cost and flexibility of the mortgage. By taking the time to comparison shop, you can increase your chances of finding the best mortgage rate for your situation.

Negotiating Mortgage Rates

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

Negotiating mortgage rates can lead to significant savings over the life of your loan. Start by researching current market rates and understanding your financial situation. Utilize your credit score and financial stability as bargaining chips during negotiations. Compare offers from different lenders and seek pre-approval to strengthen your negotiating position. If you receive a higher quote, don't be afraid to counteroffer or explore alternative lenders. Remember, the terms of your mortgage are negotiable, so don't settle for less than the best rate possible.

Negotiation strategies for lower rates

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

When negotiating for lower mortgage rates, start by researching current market rates and understanding your financial situation. Utilize your credit score and financial stability as bargaining chips during negotiations. Shop around and compare offers from different lenders to strengthen your negotiating position. Seek pre-approval to show lenders that you are a serious buyer. If you receive a higher quote, counteroffer or explore alternative lenders. Remember, the terms of your mortgage are negotiable, so don't settle for less than the best rate possible.

Working with lenders to secure favorable terms

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

When working with lenders to secure favorable terms for your mortgage, start by researching different lenders and their offerings, including interest rates and fees. Compare the options and choose the lender that best suits your needs. Be prepared to negotiate the terms of your mortgage, including interest rates, closing costs, and loan duration. It's important to communicate openly with your lender and provide any necessary documentation promptly. Remember to review the loan agreement thoroughly and ask questions if anything is unclear. By working closely with your lender, you can increase your chances of securing favorable terms for your mortgage.

Conclusion

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

In conclusion, mastering mortgage rates is essential for securing the best deal on your mortgage. By understanding how mortgage rates work, the factors that influence them, and the types of mortgage rates available, you can make informed decisions. Improving your credit score, shopping around for the best rates, and negotiating with lenders can help you secure favorable terms. Remember to communicate openly with your lender and review the loan agreement thoroughly. With these tips, you'll be well-equipped to navigate the mortgage rate landscape and secure the best deal for your needs.

Summary of key points on mastering mortgage rates

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

In summary, mastering mortgage rates requires understanding how they work, the factors that influence them, and the types available. It's important to improve your credit score, comparison shop for the best rates, and negotiate with lenders. By taking these steps, you can secure a favorable mortgage rate. Remember to communicate openly with your lender and thoroughly review the loan agreement. With these key points in mind, you'll be well-equipped to navigate the mortgage rate landscape and secure the best deal for your needs.

Next steps in securing the best mortgage rate

|

| Mastering Mortgage Rates: Your Guide to Getting the Best Deal |

Next steps in securing the best mortgage rate involve gathering all necessary documents, submitting a loan application, and providing any additional information requested by the lender. It's important to respond promptly to any inquiries and keep track of the progress of your application. Once approved, carefully review the loan terms and conditions before signing the agreement. Lastly, make sure to stay in touch with your lender throughout the process and ask any questions you may have.