Importance of Social Security Benefits

|

| Planning Ahead: Strategies to Secure the Highest Social Security Benefit in 2025 |

Social Security Benefits play a crucial role in retirement planning, providing a steady income stream that can supplement other sources of income. Maximizing Social Security Benefits is crucial, as it can have a significant impact on your financial future and help ensure a comfortable retirement. By understanding the current Social Security landscape and implementing strategies to secure the highest benefit, you can optimize your retirement income. It's essential to consider factors such as claiming age, spousal benefits, and investment planning to make the most of your Social Security benefits. By navigating the regulations and avoiding common pitfalls, you can secure the maximum Social Security benefit in 2025 and beyond.

Why maximizing Social Security Benefits is crucial for retirement

|

| Planning Ahead: Strategies to Secure the Highest Social Security Benefit in 2025 |

Maximizing Social Security Benefits is crucial for retirement as it provides a reliable and steady income stream that can supplement other sources of income. By securing the highest benefit, individuals can ensure a comfortable retirement and mitigate the risk of financial insecurity. Taking advantage of available strategies, such as timing your claims and utilizing spousal benefits, can help individuals optimize their Social Security income and enhance their overall financial well-being during retirement. It's important to plan ahead and make informed decisions to maximize the potential benefits of Social Security.

Understanding the impact of Social Security on your financial future

|

| Planning Ahead: Strategies to Secure the Highest Social Security Benefit in 2025 |

Understanding the impact of Social Security on your financial future is crucial for making informed decisions and ensuring a stable retirement income. It is important to evaluate how Social Security benefits will factor into your overall retirement plan and consider the potential impact of any changes to the system. By comprehending the role of Social Security in your financial future, you can better assess your retirement needs, make appropriate savings decisions, and optimize your benefits for maximum security. Take the time to educate yourself and consult with financial professionals to navigate the complexities of Social Security and secure a stable financial future.

Current Social Security Landscape

Current Social Security Landscape

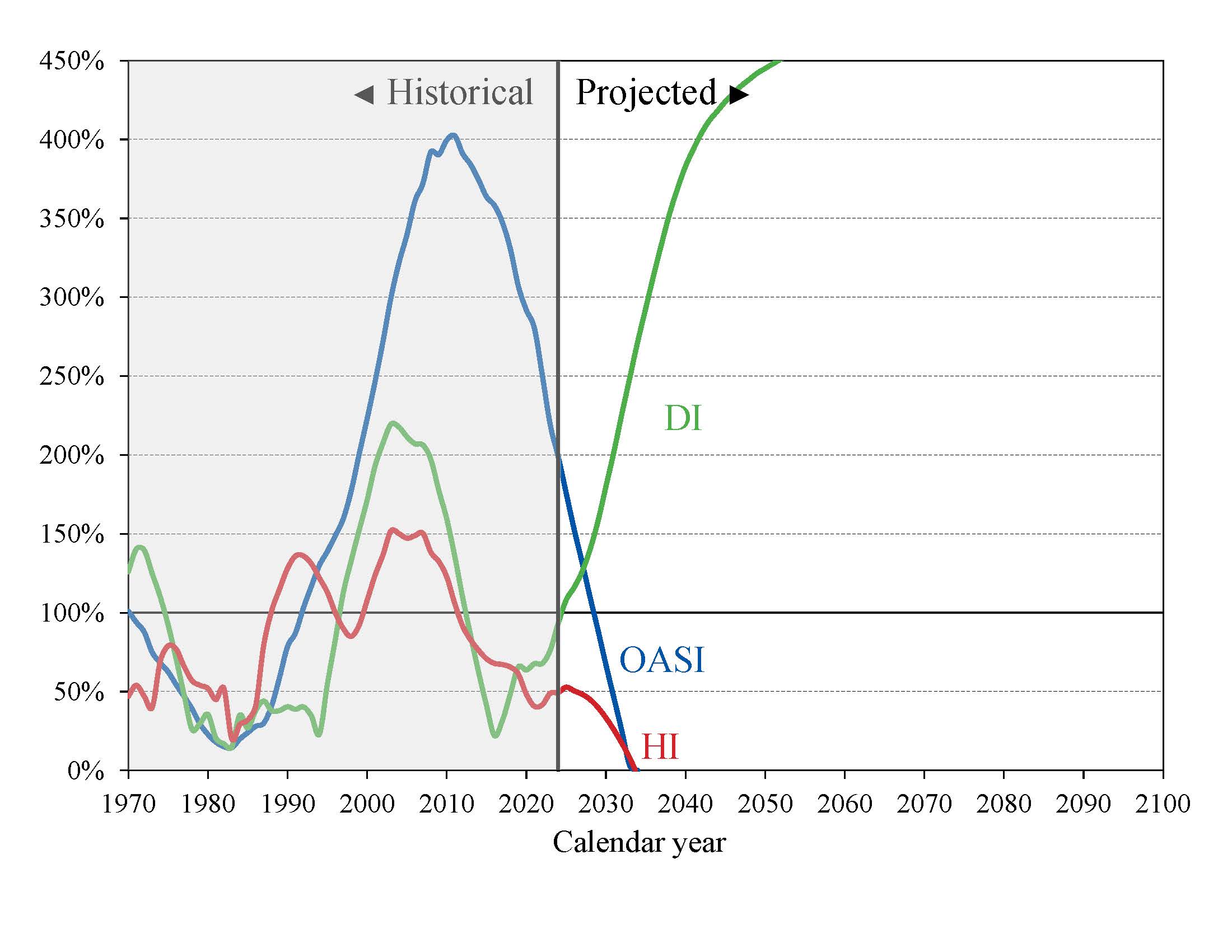

The Social Security system in 2025 is subject to various factors that can impact the amount of benefits received. These factors include changes in the cost of living, adjustments to the retirement age, and potential changes to the funding structure. It is important to stay informed about these factors and how they may affect your Social Security benefits. Considering these elements when planning for retirement can help you make informed decisions and maximize your benefits.

Overview of Social Security system in 2025

The Social Security system in 2025 is subject to various factors that can impact the amount of benefits received. These factors include changes in the cost of living, adjustments to the retirement age, and potential changes to the funding structure. It is important to stay informed about these factors and how they may affect your Social Security benefits. Considering these elements when planning for retirement can help you make informed decisions and maximize your benefits.

Factors affecting Social Security benefits in the future

The future of Social Security benefits is influenced by several factors, including changes in the cost of living, adjustments to the retirement age, and potential modifications to the funding structure. Considering these factors is essential for planning and maximizing your benefits. It's important to stay informed about potential changes and adapt your retirement strategy accordingly to ensure financial security in the future. Taking proactive steps to understand how these factors may impact your benefits can help you make informed decisions and optimize your Social Security income.

Strategies for Maximizing Social Security Benefits

Strategies for Maximizing Social Security Benefits

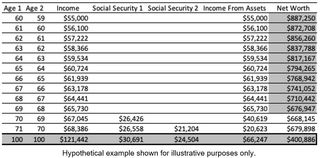

- Plan ahead: To secure the highest Social Security benefit, start planning early and consider factors like your retirement age and work history.

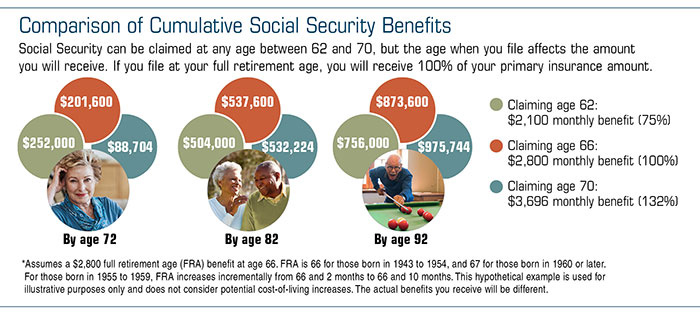

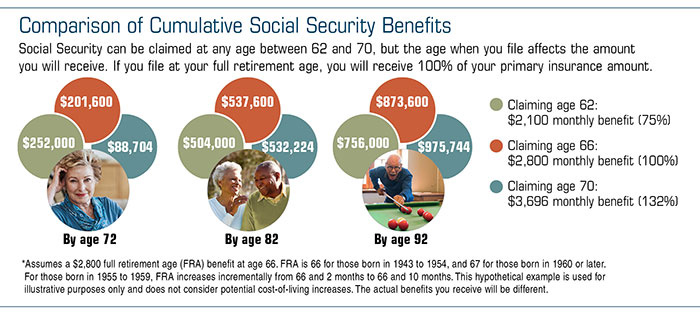

- Optimize claiming: Timing is crucial when claiming Social Security. Delaying your claim until full retirement age can result in higher monthly benefits.

- Utilize spousal benefits: If you are married, explore strategies to maximize spousal benefits. Coordinating your claiming strategies can maximize your combined benefits.

- Invest wisely: Consider how your investment decisions can impact your Social Security benefits. Earning additional income during retirement may subject your benefits to taxation.

- Seek professional help: Consulting with a financial advisor or Social Security specialist can help you navigate the complex rules and regulations and make informed decisions.

Planning ahead: Key strategies to secure the highest benefit

One important strategy for maximizing Social Security benefits is to plan ahead and implement key strategies to secure the highest benefit. This involves factors such as determining your retirement age and considering your work history. By starting early and making informed decisions, you can optimize your Social Security claim and potentially increase your monthly benefits. It is crucial to understand the rules and regulations surrounding Social Security to navigate the system effectively. Consulting with a financial advisor or Social Security specialist can provide guidance and help you make the best decisions for your future.

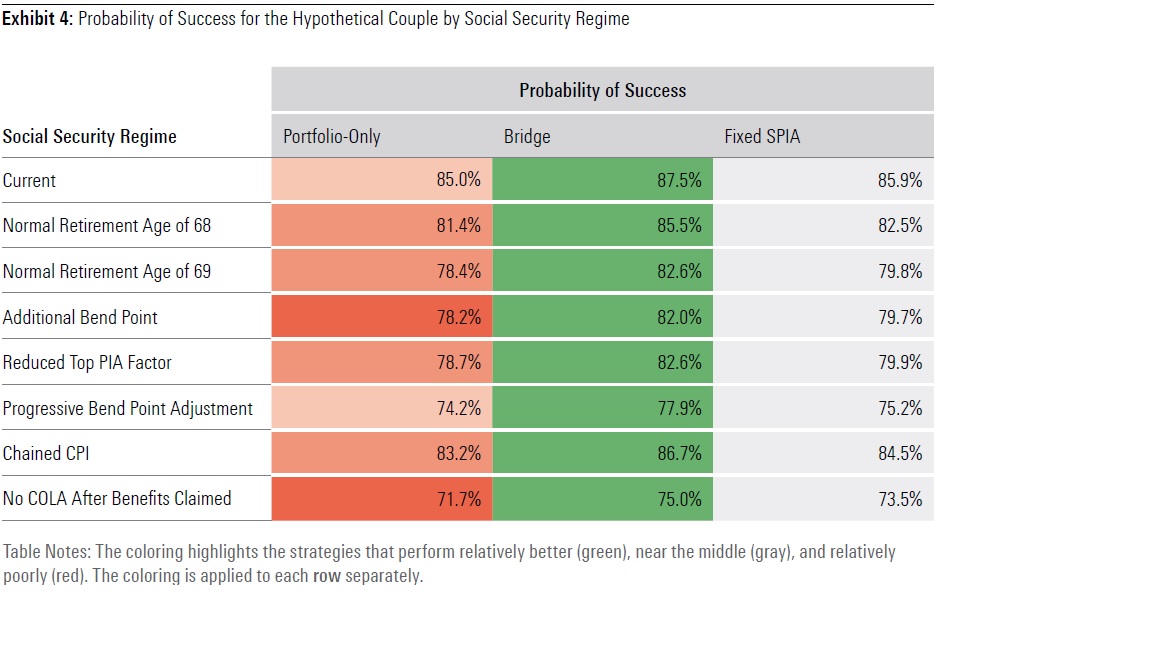

Utilizing spousal benefits and timing of claiming Social Security

When it comes to maximizing your Social Security benefits, understanding the importance of utilizing spousal benefits and timing your claim is crucial. By coordinating with your spouse, you can potentially receive a higher monthly benefit by taking advantage of spousal benefits. Additionally, careful consideration of the timing of your claim can result in increased monthly payments. Consulting with a financial advisor or Social Security specialist can help you navigate these strategies and ensure you make the most informed decisions.

Investment and Retirement Planning

Investment and Retirement Planning

Investment and retirement planning are crucial for ensuring financial security during your retirement years. Here are some actionable steps to consider:

- Start early: Begin investing in retirement accounts as soon as possible to take advantage of compounding interest.

- Diversify your portfolio: Spread your investments across different asset classes to minimize risk.

- Regularly review and adjust: Monitor the performance of your investments and make necessary adjustments to align with your retirement goals.

- Consider working with a financial advisor: Seek professional guidance to develop a personalized investment and retirement plan.

- Continuously contribute: Make regular contributions to your retirement accounts to maximize savings potential.

Remember, careful planning and strategic investment decisions can significantly impact your retirement income.

How investing early can impact your Social Security benefits

Investing early can have a significant impact on your Social Security benefits. By starting to invest in retirement accounts as soon as possible, you can take advantage of compounding interest and potentially grow your savings over time. This can lead to higher retirement income and a larger Social Security benefit when you eventually claim it. Remember to regularly contribute to your retirement accounts and review and adjust your investments as needed to maximize your savings potential and ensure a secure financial future.

Retirement planning tips to complement your Social Security income

Retirement planning tips to complement your Social Security income

- Start saving early: Begin contributing to retirement accounts as soon as possible to take advantage of compounding interest.

- Diversify your investments: Spread your savings across different asset classes to mitigate risk and maximize potential returns.

- Increase contributions over time: Continually review and adjust your savings plan to ensure you're saving enough for retirement.

- Consider working longer: Delaying retirement can increase your Social Security benefits and provide more time to boost your savings.

- Develop a comprehensive financial plan: Consult with a financial advisor to create a personalized retirement strategy that complements your Social Security income.

Navigating Social Security Regulations

Navigating Social Security regulations can be a complex process, but with the right approach, you can maximize your benefits. Here are some actionable steps to help you navigate the regulations effectively:

- Familiarize yourself with the rules: Take the time to understand the Social Security rules and regulations that apply to your situation. This includes knowing the eligibility requirements, how benefits are calculated, and the various claiming strategies available.

- Plan for the long term: Consider your long-term financial goals and how Social Security benefits fit into your overall retirement plan. This may involve working with a financial advisor to develop a strategy that maximizes your benefits while minimizing potential risks.

- Optimize your claiming strategy: Timing is crucial when it comes to claiming Social Security benefits. By delaying your claim, you can potentially increase your monthly benefit amount. However, everyone's situation is unique, so it's important to consider your individual circumstances before making a decision.

- Stay informed: Social Security regulations may change over time, so it's essential to stay updated on any updates or amendments that may impact your benefits. This includes understanding the potential impact of changes in the Social Security COLA (Cost-of-Living Adjustment) and other factors that can affect benefit calculations.

- Seek professional guidance: Navigating Social Security regulations can be overwhelming, especially if you have a complex financial situation. Consider working with a financial advisor or Social Security specialist who can provide personalized guidance based on your specific needs and goals.

By taking these steps and proactively navigating Social Security regulations, you can optimize your benefits and achieve a more secure retirement.

Understanding the rules and regulations related to Social Security

To navigate Social Security regulations effectively, it's crucial to have a thorough understanding of the rules and regulations related to Social Security. Familiarize yourself with eligibility requirements, benefit calculations, and claiming strategies available. Stay updated on any changes in regulations, such as the Social Security COLA, and consider seeking professional guidance to navigate the complexities. By understanding the rules and regulations, you can make informed decisions that maximize your Social Security benefits and help secure a more comfortable retirement.

Avoiding common pitfalls and maximizing your benefits

To avoid common pitfalls and maximize your Social Security benefits, consider delaying your claim until full retirement age or even later if possible, as this will increase your monthly benefit. Additionally, review your earnings history for accuracy and ensure you have the required 35 years of substantial earnings to qualify for the maximum benefit. Finally, consult with a financial advisor who specializes in Social Security to develop a personalized claiming strategy that takes into account your individual circumstances.

Conclusion

In conclusion, securing the highest Social Security benefit in 2025 requires careful planning and strategic decision-making. By delaying your claim until full retirement age or later, ensuring accuracy in your earnings history, and consulting with a financial advisor, you can maximize your benefits. It's important to understand the rules and regulations of Social Security and avoid common pitfalls. By taking these steps, you can optimize your Social Security benefits and create a more secure financial future for your retirement.

Summarizing the strategies discussed for securing the highest Social Security benefit in 2025

To secure the highest Social Security benefit in 2025, it is important to follow key strategies. These include delaying your claim until full retirement age or later and ensuring accuracy in your earnings history. Consulting with a financial advisor can also help you make informed decisions. Utilizing spousal benefits and timing your Social Security claim are additional strategies to maximize your benefits. Additionally, investing early and planning for retirement can have a significant impact on your Social Security benefits. Understanding the rules and regulations related to Social Security is essential to avoid common pitfalls and optimize your benefits.

Next steps for optimizing your Social Security benefitsuse these keywords where appropriate

Next steps for optimizing your Social Security benefits in 2025 include reviewing your earnings record for accuracy, consulting with a financial advisor to make informed decisions, and considering the impact of claiming strategies such as delaying your claim until full retirement age or utilizing spousal benefits. Additionally, it is crucial to start investing early and planning for retirement to maximize your Social Security benefits. Stay informed about the rules and regulations related to Social Security to avoid common pitfalls and ensure you receive the highest benefit possible.