What is a Roth IRA and Why Choose E*TRADE

A Roth IRA is a retirement account that offers tax-free growth and withdrawals in retirement. It can be a great option for building a secure future. E*TRADE, a popular brokerage platform, offers Roth IRA accounts that give you access to a wide range of investment choices.

By choosing ETRADE for your Roth IRA, you benefit from the expertise and resources of Morgan Stanley, a leading financial institution. ETRADE provides a user-friendly platform and offers various investment options, including mutual funds, stocks, and bonds. With E*TRADE, you can easily manage your retirement savings and make informed investment decisions.

In addition, ETRADE offers competitive fees and a range of account features to suit your needs. Whether you're a beginner or an experienced investor, ETRADE makes it easy to start saving for retirement and take control of your financial future.

What is a Roth IRA and its benefits

A Roth IRA is a retirement account that offers tax-free growth and withdrawals in retirement. It is a great option for building a secure future. With a Roth IRA, you contribute after-tax money, which means you won't have to pay taxes on your withdrawals in retirement. This allows your investments to potentially grow without being subject to taxes. The benefits of a Roth IRA include flexibility in contributions and withdrawals, no required minimum distributions, and the ability to pass on the account to your beneficiaries. It's a smart choice for retirement planning and can provide financial security in the long run.

Advantages of choosing E*TRADE for Roth IRA

When it comes to choosing ETRADE for your Roth IRA, there are several advantages to consider. First and foremost, ETRADE is backed by Morgan Stanley, one of the leading financial institutions. This means you can trust their expertise and experience in managing retirement accounts.

E*TRADE offers a wide range of investment choices, including mutual funds, stocks, and bonds. This allows you to diversify your portfolio and potentially maximize your returns.

With E*TRADE, you can easily open and manage your Roth IRA account online. They provide user-friendly platforms and tools to track your investments and make informed decisions.

Furthermore, E*TRADE provides educational resources and daily newsletters to help you expand your financial knowledge and stay updated on market trends.

In summary, choosing E*TRADE for your Roth IRA gives you access to a popular brokerage with a wide range of investment options, backed by the expertise of Morgan Stanley.

E*TRADE Roth IRA Account Types

ETRADE offers various Roth IRA account types to suit your individual needs. These options include Traditional IRAs and Roth IRAs, which both provide tax advantages for your retirement savings. You can also benefit from ETRADE's Core Portfolios, which are automated investment portfolios tailored to your goals and risk tolerance.

If you already have a retirement account with another provider, ETRADE offers Roth IRA Rollover and Conversion options. This allows you to transfer funds from a Traditional IRA or other similar accounts into your ETRADE Roth IRA.

E*TRADE also provides Custodial Accounts, Coverdell ESAs, Simple IRAs, SEP IRAs, and Inherited Retirement Accounts, giving you a wide range of choices for different financial situations.

With E*TRADE, you have access to a comprehensive suite of account options and the expertise of Morgan Stanley financial advisors.

E*TRADE Roth IRA Traditional vs Roth IRA

E*TRADE Roth IRA Traditional vs Roth IRA

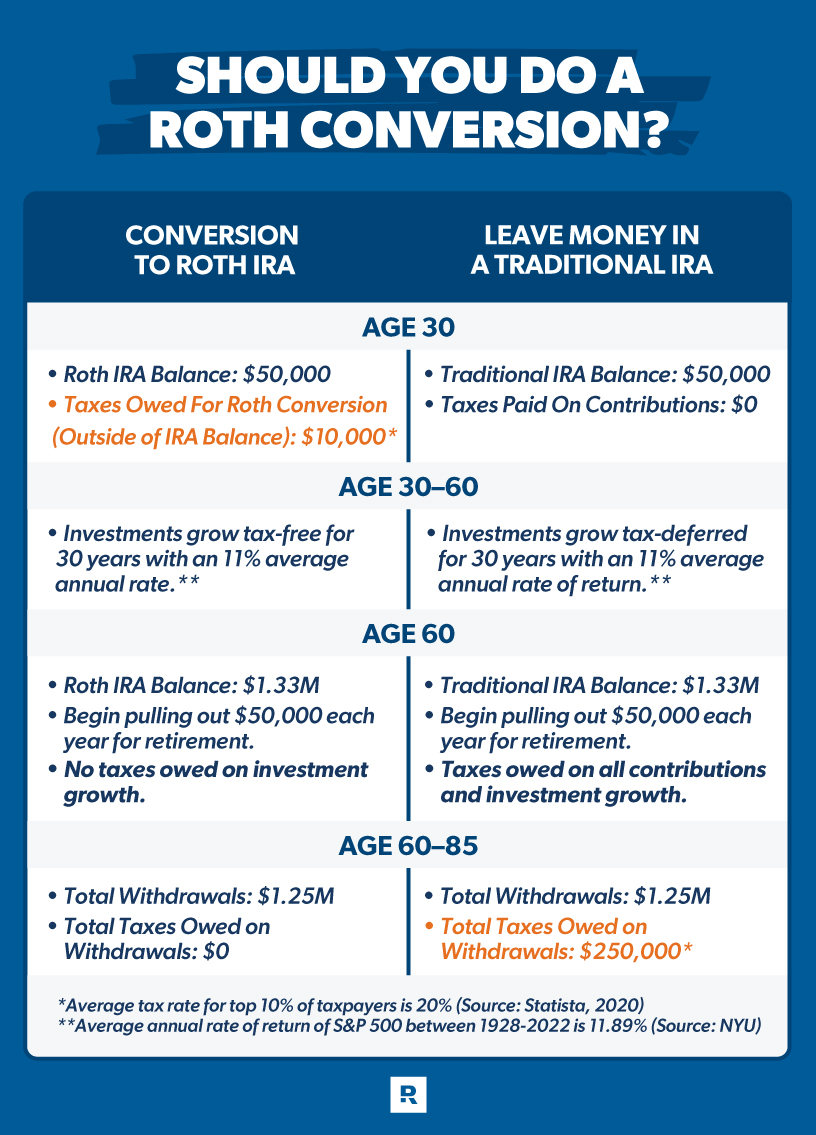

When considering your retirement savings options, it's important to understand the difference between a Traditional IRA and a Roth IRA. With a Traditional IRA, your contributions are made with pre-tax dollars, and you may be eligible for a tax deduction. However, you'll be required to pay taxes on your withdrawals in retirement. On the other hand, with a Roth IRA, your contributions are made with after-tax dollars, but your withdrawals in retirement are tax-free.

ETRADE offers both Traditional IRAs and Roth IRAs, allowing you to choose the option that aligns with your financial goals and tax strategy. With ETRADE, you have access to a wide range of investment choices, including mutual funds, stocks, and bonds.

Consider speaking with a financial advisor to determine which type of IRA is best for you and how E*TRADE can help you achieve your retirement goals.

E*TRADE Roth IRA Rollover and Conversion options

ETRADE provides flexible options for rolling over and converting your existing retirement accounts to a Roth IRA. If you have a Traditional IRA or a 401(k) from a previous employer, you can easily transfer the funds into an ETRADE Roth IRA. This allows you to take advantage of the potential tax-free growth and tax-free qualified distributions in retirement.

Additionally, E*TRADE offers the option to convert a Traditional IRA to a Roth IRA. This conversion can be done at any time and may be beneficial if you expect your tax rate to be higher in the future. However, it's important to note that you will have to pay taxes on the amount converted.

E*TRADE offers resources and guidance to help you navigate the rollover and conversion process, making it easy to switch to a Roth IRA and take control of your retirement savings.

E*TRADE Roth IRA Investment Options

ETRADE offers a wide range of investment options for your Roth IRA. With access to Morgan Stanley's vast resources, you can choose from various investment choices to build a diversified portfolio. Whether you prefer mutual funds, stocks, bonds, or ETFs, ETRADE has you covered.

You can take advantage of ETRADE's Core Portfolios, which provide a professionally managed portfolio tailored to your risk tolerance and time horizon. ETRADE also offers self-directed brokerage accounts, giving you the flexibility to trade and invest on your own.

No matter your investment strategy, ETRADE has the tools and expertise to help you make informed decisions and grow your retirement savings. With ETRADE, you can confidently invest in the future and secure a comfortable retirement.

E*TRADE Roth IRA Mutual Funds and ETFs

When it comes to ETRADE's Roth IRA options, you have access to a wide range of investment choices, including mutual funds and ETFs. With ETRADE's partnership with Morgan Stanley, you can trust in the expertise and resources available to help you build a diversified portfolio.

E*TRADE offers a variety of mutual funds, which are professionally managed and allow you to invest in a diverse range of assets. These funds provide you with the opportunity to potentially grow your retirement savings over time.

In addition to mutual funds, E*TRADE also offers ETFs (Exchange-Traded Funds). ETFs are similar to mutual funds but are traded on the stock exchange like individual stocks. This provides you with the opportunity to trade and invest in a wide range of assets, such as stocks, bonds, and commodities.

With E*TRADE, you have the flexibility to choose between mutual funds and ETFs to suit your investment goals and risk tolerance. This allows you to create a diversified portfolio tailored to your specific needs.

E*TRADE Roth IRA Stocks and Bonds

ETRADE offers a wide range of investment options for your Roth IRA, including stocks and bonds. With ETRADE's partnership with Morgan Stanley, you can access the expertise and resources needed to make informed investment decisions.

Stocks provide the opportunity to invest in individual companies and participate in their growth potential. Bonds, on the other hand, offer a fixed income stream and are considered more conservative investments.

You can choose from a variety of stocks and bonds to build a diversified Roth IRA portfolio that aligns with your financial goals and risk tolerance. E*TRADE provides research tools and educational resources to help you make informed investment decisions.

Whether you're interested in stocks or bonds, E*TRADE's Roth IRA options allow you to take advantage of the potential for long-term growth while maintaining a balanced and diversified portfolio.

E*TRADE Roth IRA Fees and Requirements

E*TRADE Roth IRA Fees and Requirements

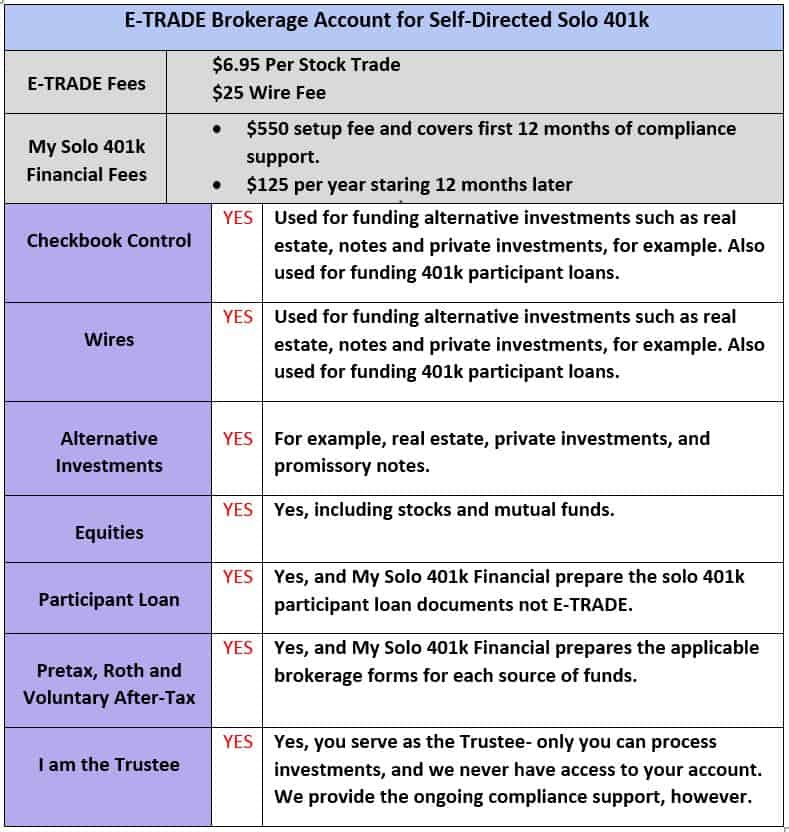

When it comes to fees, E*TRADE provides a transparent fee structure for their Roth IRA accounts. There is no annual fee, no inactivity fee, and no account setup fee. However, there may be some transaction fees for certain types of trades or mutual fund purchases.

To open an E*TRADE Roth IRA, you will need to meet the eligibility requirements set by the IRS. You must have earned income and meet the income limits specified for Roth IRAs. Additionally, you must be under the age of 70 ½ and have a valid Social Security number.

E*TRADE offers a wide range of investment choices for Roth IRA accounts, including stocks, bonds, mutual funds, and ETFs. You have the flexibility to choose the investment options that align with your financial goals and risk tolerance.

In conclusion, ETRADE's Roth IRA fees are competitive and their requirements are straightforward. You can easily open an account and start investing in your future with the guidance of ETRADE and its partnership with Morgan Stanley.

E*TRADE Roth IRA Fees breakdown

ETRADE provides a transparent fee structure for their Roth IRA accounts. There is no annual fee, inactivity fee, or account setup fee. However, some transaction fees may apply for certain trades or mutual fund purchases. It's important to review the fee schedule for details on these charges. ETRADE offers a variety of investment choices for your Roth IRA, including stocks, bonds, mutual funds, and ETFs. You have the flexibility to choose the investments that align with your financial goals and risk tolerance. With E*TRADE's partnership with Morgan Stanley, you can access additional financial knowledge and advice to help you make informed investment decisions.

Eligibility requirements for E*TRADE Roth IRA

To open a Roth IRA with ETRADE, you need to meet certain eligibility requirements. Firstly, you must have earned income, such as wages, salaries, or self-employment income. Secondly, you must be under the age of 70 and a half. However, there are income limits for Roth IRA contributions. For single filers, the modified adjusted gross income (MAGI) must be below $140,000 in 2021, and for married couples filing jointly, the MAGI must be below $208,000. Keep in mind that these limits may change each year, so it's essential to stay updated. Overall, if you meet these requirements, you can take advantage of the benefits of a Roth IRA with ETRADE.

Planning for Retirement with E*TRADE Roth IRA

Planning for Retirement with E*TRADE Roth IRA

When it comes to planning for retirement, ETRADE Roth IRA can be a valuable tool. With its tax-free qualified distributions, you can build a secure future. Start by setting financial goals and determining how much you need for retirement. ETRADE offers a range of investment choices, including mutual funds and stocks, to help you grow your retirement savings. Maximize your contributions each year and take advantage of ETRADE's financial knowledge and daily newsletters to stay informed. With ETRADE Roth IRA, you have the flexibility to manage your investments and make adjustments as needed. Plan for a secure retirement with E*TRADE Roth IRA.

Setting financial goals for retirement

Setting financial goals for retirement

To ensure a secure future, it's important to set clear and achievable financial goals for your retirement. Start by determining how much income you will need during your retirement years. Consider factors such as lifestyle expenses, healthcare costs, and inflation. Take into account your current savings and investments, including any retirement accounts like a Roth IRA. Evaluate your risk tolerance and time horizon to determine your investment strategy. Set specific milestones and a timeline for reaching your goals. Regularly review and adjust your goals as needed to stay on track. With careful planning and discipline, you can build a solid foundation for your retirement years with E*TRADE Roth IRA.

Managing and maximizing contributions

Managing and maximizing contributions to your ETRADE Roth IRA is essential for building a secure future. Review your cash flow and budget to determine the amount you can comfortably contribute each year. Take advantage of the annual contribution limit, which for 2021 is $6,000 ($7,000 if you are 50 or older). Consider setting up automatic contributions to ensure consistency. Take advantage of employer matching programs, if available. Utilize the flexibility of ETRADE's Roth IRA investment options, such as mutual funds, stocks, and bonds, to diversify your portfolio and potentially maximize returns. Regularly review your investment performance and adjust as needed. Remember, every dollar you contribute now can potentially grow tax-free and provide financial security for your retirement years.

Conclusion

Conclusion

In conclusion, ETRADE's Roth IRA options provide a secure and flexible way to plan for your future. With ETRADE, you can take advantage of the benefits of a Roth IRA, such as tax-free growth and tax-free qualified distributions in retirement. The variety of investment choices, including mutual funds, stocks, and bonds, allows you to customize your portfolio and potentially maximize your returns. ETRADE's low fees and user-friendly platform make it a popular brokerage for managing your Roth IRA. Whether you're just starting your retirement savings or looking to rollover an existing account, ETRADE's Roth IRA options can help you achieve your financial goals. Start planning for your future today with E*TRADE's Roth IRA.

Benefits of E*TRADE Roth IRA for secure future

Benefits of E*TRADE Roth IRA for secure future

Investing in an ETRADE Roth IRA offers numerous benefits for securing your future. With its range of investment choices, including mutual funds and stocks, you have the flexibility to build a diversified portfolio that aligns with your goals. ETRADE's user-friendly platform and low fees make it easy to manage your account and maximize your returns. Plus, as a part of Morgan Stanley, you can tap into the expertise and guidance of financial advisors to make informed decisions. You also enjoy the advantage of tax-free growth and tax-free qualified distributions in retirement, providing you with peace of mind and a potentially higher after-tax income. E*TRADE's Roth IRA is a smart choice for ensuring a secure and comfortable future.

Frequently Asked Questions

Frequently Asked Questions

- Can I open a Roth IRA with ETRADE?

Yes, you can easily open a Roth IRA account with ETRADE. It's a straightforward process and can be done online. - What are the contribution limits for a Roth IRA?

For 2021 and 2022, the contribution limit for a Roth IRA is $6,000, or $7,000 if you are age 50 or older. However, these limits may change in future years, so it's always good to check for updates. - Can I contribute to both a Roth IRA and a Traditional IRA?

Yes, you can contribute to both a Roth IRA and a Traditional IRA in the same year. However, the combined annual contribution limit across both accounts still applies. - Can I roll over my Traditional IRA into a Roth IRA?

Yes, you have the option to convert your Traditional IRA into a Roth IRA. However, keep in mind that this conversion may result in taxes being owed on the amount converted. - What investment options are available within an ETRADE Roth IRA?

ETRADE offers a wide range of investment choices for your Roth IRA, including mutual funds, stocks, bonds, and ETFs. You have the flexibility to build a diversified portfolio that aligns with your investment goals. - Are there any fees associated with an ETRADE Roth IRA?

ETRADE has a transparent fee structure for their Roth IRA accounts. You may incur fees for account maintenance, trades, or fund expenses. It's important to review the fee schedule and understand the costs associated with your account. - Can I withdraw funds from my E*TRADE Roth IRA before retirement?

Yes, you can withdraw your contributions from a Roth IRA at any time without penalties. However, if you withdraw earnings before age 59½, you may be subject to taxes and penalties.

Remember, it's always a good idea to consult with a financial advisor or tax professional regarding your specific situation and to ensure you are making the most informed decisions for your retirement savings.