Importance of Retirement Planning

Retirement planning is crucial for securing your financial future. It allows you to determine how much money you need to save in order to maintain your desired lifestyle after you stop working. Without retirement planning, you may find yourself struggling to cover expenses during your golden years. By diligently saving and investing, you can ensure a comfortable retirement and achieve financial independence.

Retirement planning helps you identify areas where you can cut costs, such as credit card debt or unnecessary expenses. It also enables you to explore various retirement savings options, such as savings accounts, CDs, or home equity loans. With the help of the best retirement calculator, you can make informed decisions and confidently plan for a secure retirement.

Importance of using a retirement calculator

Using a retirement calculator is essential for effective retirement planning. It helps you determine how much money you need to save in order to achieve your desired retirement income goals. With a retirement calculator, you can easily analyze different scenarios and adjust your savings strategy accordingly. Without one, you might underestimate or overestimate your needed savings, which can greatly impact your retirement security.

A retirement calculator takes into account factors such as your current age, retirement age, expected expenses, and investment returns, providing you with accurate estimates and projections. By using the best retirement calculator, you can confidently plan for your future and make informed decisions about your retirement savings.

Benefits of maximizing savings for retirement

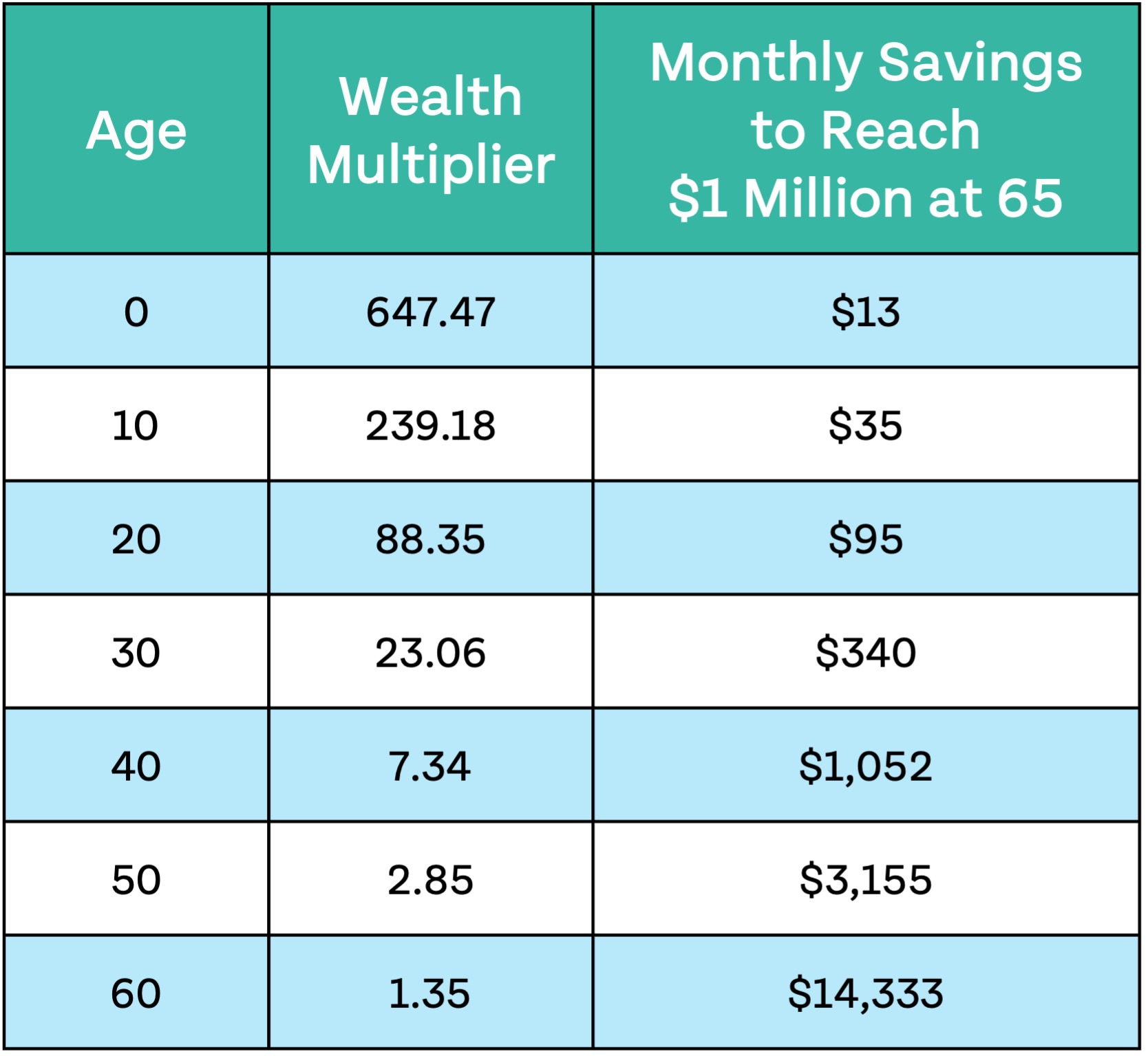

Maximizing your savings for retirement comes with a range of benefits. Firstly, it ensures that you have enough money to cover your retirement expenses, allowing you to maintain your desired lifestyle without sacrificing financial security. By saving more now, you can also take advantage of compound interest over time, helping your retirement savings grow exponentially.

Additionally, maximizing your savings can provide you with peace of mind, knowing that you have a solid financial foundation for your retirement years. It also allows for flexibility in case unexpected expenses arise. Ultimately, having a substantial retirement nest egg gives you the freedom to pursue your hobbies and interests without worrying about money.

Understanding Retirement Calculators

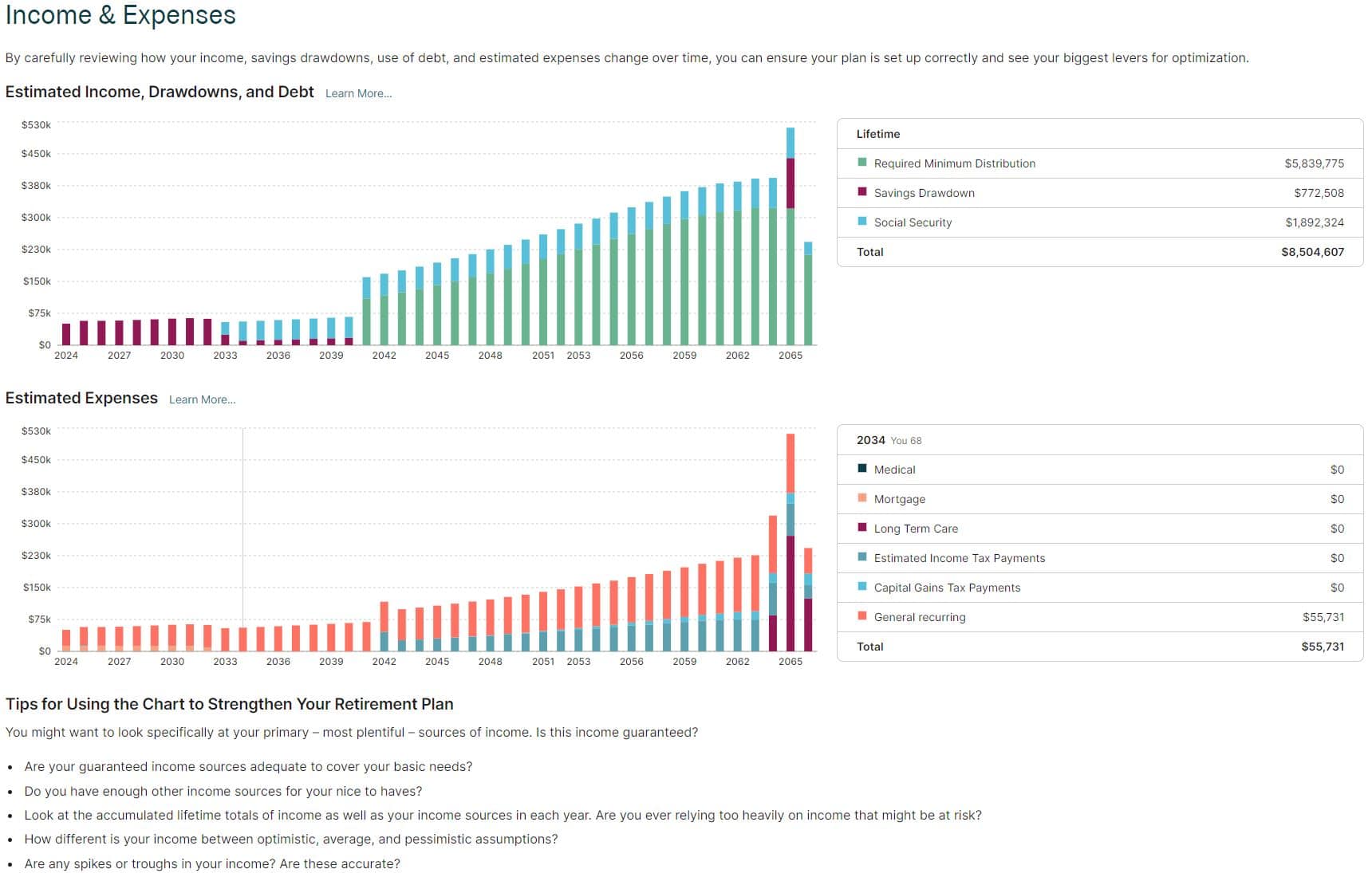

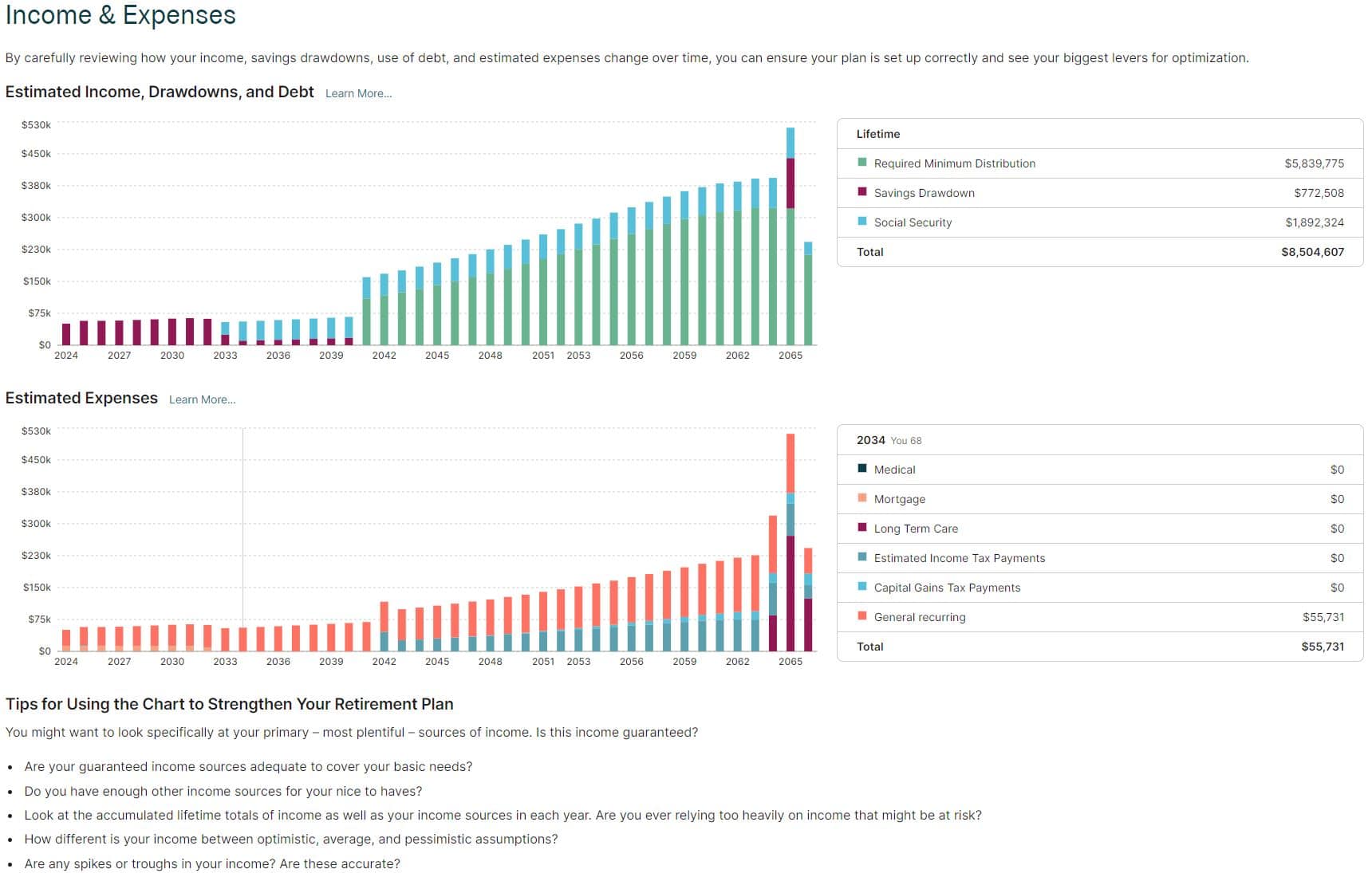

Retirement calculators are essential tools for understanding your retirement savings goals. These calculators work by analyzing various factors such as your current age, desired retirement age, annual income, expenses, and investment returns. They provide you with an estimate of how much money you need to save to maintain your desired lifestyle during retirement.

By using these calculators, you can gain a clear understanding of your retirement savings trajectory and make informed decisions about your financial future.

Understanding retirement calculators can help you determine whether your current savings strategy is on track or if you need to adjust your approach. It allows you to explore different scenarios and see how changes in factors like your retirement date or investment returns can impact your savings. With this information, you can make necessary adjustments to meet your retirement goals with confidence.

Retirement calculators also provide you with a realistic perspective on your retirement expenses. They take into account common expenses like housing, healthcare, and daily living costs. Moreover, they can help you identify areas where you may need to reduce spending or increase savings to ensure a comfortable retirement.

Using a retirement calculator gives you a comprehensive view of your retirement plan. It helps you assess if you are saving enough to maintain your lifestyle and achieve your long-term goals. By considering factors such as inflation and life expectancy, retirement calculators provide a more accurate picture of your financial needs during retirement.

It's important to note that while retirement calculators provide useful insights, they are not one-size-fits-all solutions. Individual circumstances and financial goals differ, so it's crucial to use retirement calculators as a starting point for your planning. Consider consulting with a financial advisor who can provide personalized guidance based on your unique situation.

Overall, understanding retirement calculators empowers you to take control of your retirement planning. It allows you to make informed decisions, set realistic goals, and take steps toward achieving retirement security. By utilizing the best retirement calculator for your needs, you can have complete confidence in your financial strategy and work towards a comfortable and fulfilling retirement.

How retirement calculators work

Retirement calculators work by analyzing various factors such as your current age, desired retirement age, annual income, expenses, and investment returns. They consider inflation, life expectancy, and other variables to provide you with an estimate of how much money you need to save for retirement. These calculators take into account common expenses like housing, healthcare, and daily living costs to give you a realistic perspective on your retirement expenses.

They allow you to explore different scenarios and see how changes in factors like your retirement date or investment returns can impact your savings. Retirement calculators provide a comprehensive view of your retirement plan, empowering you to make informed decisions and work towards a comfortable and fulfilling retirement.

Factors to consider when using a retirement calculator

When using a retirement calculator, there are several factors you need to consider. First, you should gather accurate and up-to-date financial information, including your current savings, annual income, and expenses. It's also important to factor in potential sources of retirement income, such as social security or pension payments.

Additionally, consider your desired retirement age and life expectancy, as these affect the length of time you will need to support yourself financially. Furthermore, it's essential to consider inflation rates and investment returns when inputting these values into the retirement calculator. By including all relevant information, you can generate more accurate estimates of your retirement savings needs.

Best Retirement Calculator Tools

Best Retirement Calculator Tools

When it comes to finding the best retirement calculator tools, there are several options to choose from. These tools are designed to help you assess your retirement savings needs and make informed decisions about your financial future. Some of the top retirement calculator tools available include comprehensive online platforms that offer a range of features and functionalities.

One popular retirement calculator tool offers a convenient PDF guide that walks you through the retirement planning process step by step. It includes sample lessons and uncommon strategies to help you maximize your savings for retirement. Another retirement calculator provides access to a restricted system that allows you to input your financial information, such as retirement expenses and annual retirement income, with complete confidence.

Additionally, there are retirement calculator tools that offer free video lessons and comprehensive wealth planning resources. These resources cover a wide range of topics, including retirement calculator tips, retirement calculator secrets, and best retirement plans. They provide valuable guidance on how to plan for retirement and ensure your financial security in your golden years.

Furthermore, there are retirement calculator tools that offer comparisons for various financial products, such as savings accounts, credit cards, and home equity loans. These tools allow you to compare rates and terms to find the best options for your retirement savings. They also provide insights into the best CD rates, best student cards, and best car insurance companies, helping you make informed financial decisions.

In conclusion, the best retirement calculator tools offer a comprehensive approach to retirement planning and savings. They provide access to valuable resources and guidance that can help you make the best choices for your financial future. Whether you are just starting your retirement planning journey or are nearing your mandatory retirement age, these tools can be instrumental in ensuring you have a secure and comfortable retirement.

Next, we will explore strategies for maximizing your savings and avoiding common retirement planning mistakes.

Top retirement calculator tools available

:max_bytes(150000):strip_icc()/FidelityRetirementCalculator-583f571e3df78c0230c057a2.jpg)

There are several top retirement calculator tools available to help you plan for your retirement savings. These calculators are designed to offer comprehensive solutions and guide you through the retirement planning process. They allow you to input your financial information, such as retirement expenses and annual retirement income, to determine how much money you need to save for a comfortable retirement.

Some retirement calculators even provide sample lessons and uncommon strategies to maximize your savings. Additionally, there are calculators that offer access to a restricted system, ensuring complete confidence in your financial information. With these tools, you can assess your retirement savings needs and make informed decisions for a secure retirement.

Features and functionalities of the best retirement calculators

The best retirement calculators offer a range of features and functionalities to help you plan for your retirement with ease. They allow you to input your retirement expenses and annual retirement income to calculate how much money you need to save. These calculators may also provide sample lessons and uncommon strategies to maximize your savings.

Additionally, some retirement calculators offer access to a restricted system, ensuring complete confidence in your financial information. They may even provide video guides and comprehensive wealth planning processes to assist you every step of the way. With the best retirement calculators, you can calculate your retirement savings score and make informed decisions for a secure retirement.

Strategies for Maximizing Savings

To maximize your retirement savings, there are a few key strategies you can implement. First, take advantage of retirement calculators to get a clear picture of how much money you need to save. This will help you set realistic financial goals.

Consider using uncommon strategies recommended by the best retirement calculators. These may include optimizing credit card rewards or using savings accounts with the best interest rates. Additionally, you can explore investment options to grow your savings, such as investing in low-cost index funds or real estate.

Don't forget to review your expenses and find ways to reduce them. Cutting back on unnecessary expenses can significantly increase your retirement savings.

Lastly, educate yourself on retirement planning by accessing free video lessons or related books. It's important to stay informed and make informed decisions for your future financial security.

Tips for increasing your retirement savings

Tips for increasing your retirement savings

- Start early: The earlier you begin saving for retirement, the more time your money has to grow. Aim to contribute consistently and maximize your contributions to take advantage of compound interest.

- Cut unnecessary expenses: Review your monthly expenses and identify areas where you can cut back. By reducing unnecessary spending, you can free up more money to put towards your retirement savings.

- Take advantage of employer contributions: If your employer offers a retirement savings plan, such as a 401(k) with matching contributions, make sure you contribute enough to receive the full match. This is essentially free money that can significantly boost your retirement savings.

- Optimize credit card rewards: Use credit cards that offer cashback or rewards programs and maximize your benefits. By strategically using your cards, you can earn rewards that can be directed towards your retirement savings.

- Utilize high-interest savings accounts: Look for savings accounts with the best interest rates. By choosing accounts with higher rates, your money can grow faster, helping you reach your retirement goals sooner.

- Consider investment opportunities: Explore investment options such as low-cost index funds or real estate. These investments have the potential to generate higher returns than traditional savings accounts and can accelerate your retirement savings growth.

- Educate yourself: Take advantage of free resources such as sample lessons or related books on retirement planning. By expanding your knowledge, you can make informed decisions and maximize your retirement savings with complete confidence.

Remember, increasing your retirement savings requires discipline and proactive planning. Implementing these tips can help you optimize your savings and secure a comfortable retirement.

Investment options for maximizing your savings

When it comes to maximizing your retirement savings, exploring investment options is crucial. Consider allocating a portion of your savings to low-cost index funds, which can provide potential high returns over the long term. Another option to consider is real estate, as it has the potential for significant growth and can generate rental income. Additionally, you may want to explore the benefits of opening a high-interest savings account and taking advantage of competitive interest rates. This can help your money grow faster and contribute to the overall growth of your retirement savings. By diversifying your investments and exploring different avenues, you can maximize your savings and ensure a secure retirement.

Retirement Planning Mistakes to Avoid

Retirement Planning Mistakes to Avoid

When it comes to retirement planning, there are some common mistakes that you should avoid to ensure a secure future. One mistake is not starting early enough. The sooner you begin saving for retirement, the more time your money has to grow. Another mistake to avoid is relying solely on your employer's retirement plan. It's important to diversify your savings by utilizing other investment vehicles such as IRAs and 401(k)s.

Not properly estimating your retirement expenses can also be a costly mistake. Take the time to calculate your anticipated expenses, including healthcare costs, and adjust your savings accordingly. Furthermore, failing to regularly review and update your retirement plan can lead to inadequate savings. Make sure to reassess your goals and make necessary adjustments along the way.

Lastly, don't underestimate the impact of inflation. Failing to factor in inflation can result in falling short of your retirement savings goal. Stay informed about inflation rates and adjust your savings plans accordingly.

By avoiding these mistakes and implementing a comprehensive retirement plan, you can set yourself up for a financially secure future.

Common mistakes to avoid when planning for retirement

Common mistakes to avoid when planning for retirement

- Not starting early enough: Waiting too long to begin saving for retirement can significantly hinder your ability to accumulate enough funds. Start as early as possible to give your money time to grow.

- Relying solely on your employer's retirement plan: While employer plans are beneficial, it's crucial to diversify your savings. Consider utilizing other investment vehicles like IRAs and 401(k)s.

- Underestimating retirement expenses: Failing to accurately estimate your retirement expenses can leave you with inadequate savings. Take the time to calculate potential healthcare costs and adjust your savings accordingly.

- Neglecting to review and update your retirement plan: Regularly reassess your goals and adjust your savings plan accordingly. Failing to do so can lead to insufficient funds for retirement.

- Overlooking the impact of inflation: Inflation erodes the purchasing power of your savings over time. Failing to factor in inflation can result in falling short of your retirement savings goal.

Avoiding these mistakes will help you ensure a financially secure future during your retirement years.

Impact of not using a retirement calculator effectively

Not using a retirement calculator effectively can have a significant impact on your retirement savings. Without proper planning, you may not have a clear understanding of how much money you need to save for retirement. This can lead to inadequate savings and a potential shortfall in retirement income.

Without the guidance of a retirement calculator, you may not accurately estimate your retirement expenses or factor in inflation. This can result in underestimating the amount of money you need for a comfortable retirement.

Furthermore, not using a retirement calculator means you might miss out on valuable strategies and investment options that can maximize your savings. Retirement calculators offer insights into different scenarios, allowing you to make informed decisions and adjust your savings plan accordingly.

In summary, not using a retirement calculator effectively can jeopardize your retirement security. It is crucial to utilize these tools to ensure complete confidence in your retirement savings plan.

Conclusion

Conclusion

In conclusion, utilizing the best retirement calculator is essential for maximizing your savings and ensuring a secure retirement. By accurately estimating your retirement expenses and factoring in inflation, you can set realistic savings goals. Retirement calculators offer valuable insights into different scenarios, allowing you to make informed decisions about your retirement plan. They provide convenient tools such as sample lessons, video guides, and access to restricted systems to help you navigate the retirement planning process. By avoiding common mistakes and utilizing retirement calculators effectively, you can confidently plan for your retirement. Don't wait any longer – take advantage of these resources and start maximizing your savings for a comfortable retirement.

Summary of key points on maximizing savings for retirement

Summary of key points on maximizing savings for retirement

- It is crucial to plan for retirement in order to ensure financial security.

- Using a retirement calculator is essential for accurate estimation of retirement expenses and setting realistic savings goals.

- By maximizing your retirement savings, you can have a comfortable and worry-free retirement.

- Retirement calculators offer valuable features and functionalities to help guide your savings strategy.

- Be sure to consider factors such as inflation, investment options, and additional income sources when using a retirement calculator.

- Avoid common mistakes in retirement planning and utilize retirement calculators effectively to make informed decisions.

- Take advantage of the resources provided by retirement calculators, such as sample lessons and video guides.

- With the best retirement calculator, you can confidently plan and save for your retirement with complete confidence.

Next steps in retirement planning and saving

Next steps in retirement planning and saving

Now that you have a better understanding of retirement planning and the benefits of using a retirement calculator, it's time to take the next steps towards maximizing your savings. Here are some actionable steps to consider:

- Review your retirement calculator results: Take a close look at the calculations and projections provided by the best retirement calculator you utilized. Analyze your retirement savings score, estimated retirement expenses, and annual retirement income. This will give you a clear picture of where you stand and help you set realistic savings goals.

- Implement a savings strategy: Based on the insights from your retirement calculator, create a detailed savings plan. Explore different savings accounts, such as high-yield savings accounts or certificates of deposit (CDs), to maximize your earnings. Consider uncommon strategies like opening a home equity loan or leveraging life insurance resources to boost your savings.

- Monitor your progress: Regularly track your retirement savings and make adjustments as needed. Review your contributions, investment performance, and expenses to ensure you stay on track to meet your retirement goals. Utilize the resources provided by retirement calculators, such as monthly sample lessons or video guides, to stay informed and make informed decisions.

- Explore additional income sources: Consider generating additional income in retirement by exploring part-time work, consulting gigs, or passive income streams. This can help supplement your retirement savings and provide added financial security.

Remember, retirement planning is an ongoing process. As you progress towards retirement, regularly revisit your retirement calculator results and adjust your savings strategy accordingly. With the best retirement calculator by your side, you can plan for your retirement with complete confidence and enjoy a financially secure future.