Introduction

The importance of branding cannot be overstated in today's highly competitive market. It is crucial for businesses to develop a unique and memorable brand identity that sets them apart from their competitors. Branding goes beyond just creating a logo and slogan; it is about telling a compelling story and conveying values that resonate with customers. By leveraging these elements, businesses can create a strong emotional connection with their target audience and establish trust and loyalty.

Additionally, branding allows businesses to establish themselves as industry leaders, differentiate themselves from competitors, and command higher prices for their products or services. Investing in branding is a strategic decision that can lead to long-term success and growth for businesses of all sizes.

Overview of the importance of monitoring mortgage rates on Bankrate

Staying updated on the current mortgage rates is crucial for borrowers and homeowners, and Bankrate is a valuable resource for monitoring these rates. By regularly checking Bankrate, individuals can stay ahead of the curve and take advantage of favorable interest rates. This allows them to make informed decisions when buying a new home or refinancing their existing mortgage.

Bankrate provides real-time information, expert analysis, and comparison tools, making it easy to track mortgage rates and find the best options. With this knowledge, borrowers can save money on interest payments, secure lower monthly mortgage payments, or even explore opportunities to pay off their mortgage faster. By utilizing Bankrate's mortgage rate monitoring tools, individuals can stay financially savvy and make the most of their homeownership journey.

Factors Impacting Mortgage Rates

Factors Impacting Mortgage Rates

When monitoring mortgage rates on Bankrate, it's important to understand the factors that can influence these rates. Economic indicators play a significant role, such as inflation rates, unemployment levels, and GDP growth. Global events also have an impact, such as geopolitical tensions or changes in central bank policies. Additionally, the Federal Reserve's monetary policy decisions can affect mortgage rates.

Borrowers should also consider their own financial profile, including credit score, loan amount, and down payment. By staying informed about these factors and how they affect mortgage rates, borrowers can make informed decisions and take advantage of favorable market conditions.

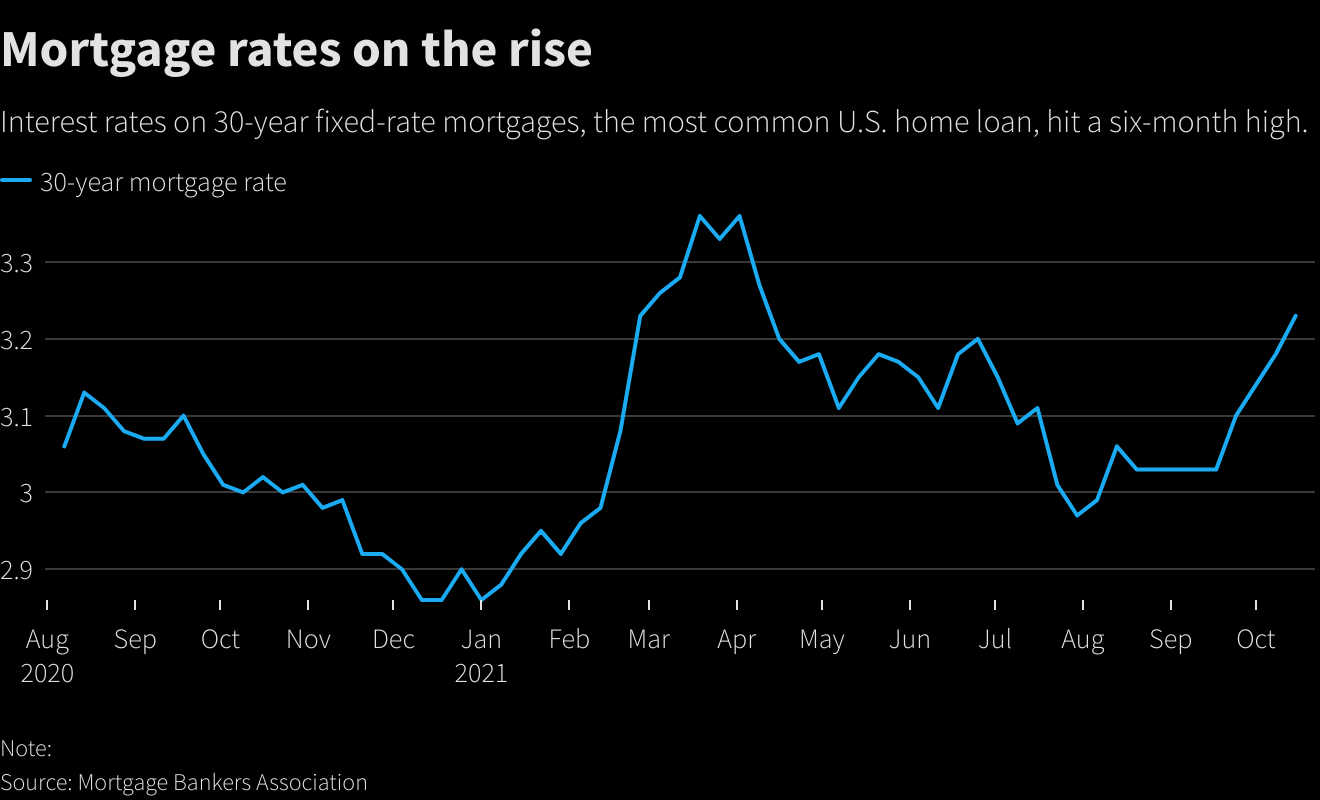

Economic indicators affecting mortgage rate fluctuations

Economic indicators, such as inflation rates, unemployment levels, and GDP growth, have a significant impact on mortgage rate fluctuations. When these indicators show signs of a strong economy, mortgage rates tend to rise. Conversely, when indicators reflect economic uncertainty or slowdown, mortgage rates often decrease. Understanding these indicators can help borrowers anticipate and track changes in mortgage rates.

Monitoring economic reports and staying informed about market trends can provide valuable insights for both current and potential homeowners. By paying attention to these indicators, borrowers can make informed decisions about when to lock in a mortgage rate and potentially save thousands of dollars over the life of their loan.

Global events and their influence on mortgage rates

Global events play a crucial role in shaping mortgage rates. When there is global economic uncertainty or geopolitical tensions, investors tend to seek safe-haven assets like US Treasury bonds, which lowers their yields and subsequently, mortgage rates. On the other hand, positive global economic news or stability can lead to increased investor confidence,

resulting in higher yields on Treasury bonds and mortgage rates. To stay ahead of these fluctuations, it is important to stay informed about global events and their potential impact on mortgage rates. Keep an eye on news related to trade agreements, financial market developments, and political events to anticipate potential rate movements and make well-informed decisions about mortgage financing.

Current Mortgage Rate Trends on Bankrate

Currently, Bankrate is reflecting a steady increase in mortgage rates. The average rate for a 30-year fixed-rate mortgage is around 3.5%, while the rate for a 15-year fixed-rate mortgage is approximately 2.8%. These rates are subject to change daily, so it is crucial to monitor them regularly. To take advantage of the lowest rates, consider locking in a mortgage rate when you find a favorable rate.

Additionally, keep an eye out for any promotions or special offers from lenders that may help lower your rate even further. By staying informed about the current mortgage rate trends on Bankrate, you can make timely decisions to secure the best financing options for your home purchase or refinance.

Analysis of the latest mortgage rate trends on Bankrate

Analysis of the latest mortgage rate trends on Bankrate is crucial for homeowners and potential buyers. By tracking these trends, you can make informed decisions about when to lock in a rate or refinance. Currently, mortgage rates on Bankrate are showing a steady increase,

with the average rate for a 30-year fixed-rate mortgage at around 3.5% and a 15-year fixed-rate mortgage at approximately 2.8%. However, it's important to regularly monitor these rates as they fluctuate daily. By staying ahead of the curve and understanding the current trends on Bankrate, you can take advantage of the best mortgage options available and potentially save thousands of dollars over the life of your loan.

Comparison of fixed-rate and adjustable-rate mortgages

When deciding between a fixed-rate and adjustable-rate mortgage, it's crucial to understand the key differences and determine which option aligns best with your financial goals. Fixed-rate mortgages offer stability with a consistent interest rate throughout the loan term, making budgeting easier. On the other hand, adjustable-rate mortgages have variable interest rates that may fluctuate over time.

This option often starts with a lower initial rate, but it's important to consider potential rate increases in the future. Evaluate your financial circumstances, long-term plans, and tolerance for risk to make an informed decision about which type of mortgage is right for you.

Tips for Securing the Best Mortgage Rates

To secure the best mortgage rates, there are several steps you can take. First, improve your credit score by paying bills on time and reducing debt. Next, save for a larger down payment, as this can lower your interest rate. Additionally, shop around and compare rates from multiple lenders to ensure you're getting the best deal.

Consider working with a mortgage broker who can help you navigate the process and negotiate on your behalf. Finally, consider locking in your rate to protect against potential rate increases. By following these tips, you can increase your chances of securing the best mortgage rates for your home purchase or refinance.

Factors to consider when shopping for mortgage rates

When shopping for mortgage rates, there are several key factors to consider. First, take into account your credit score as this can significantly impact the rates you qualify for. Next, compare rates from multiple lenders to ensure you're getting the best deal. Don't forget to consider the type of mortgage and its terms, such as fixed-rate or adjustable-rate, and the length of the loan.

It's also important to factor in any additional fees or closing costs associated with the loan. Finally, take into consideration the reputation and customer service of the lender, as a smooth mortgage experience can make a big difference. By considering these factors, you can navigate the mortgage rate shopping process more effectively.

Strategies for negotiating favorable mortgage rates

When negotiating for favorable mortgage rates, there are a few strategies you can employ. First, do your research and gather quotes from multiple lenders to compare rates. Use these quotes as leverage when negotiating with your preferred lender. Additionally, consider improving your credit score before applying for a mortgage, as a higher score can qualify you for better rates.

Don't be afraid to negotiate with your lender by asking for discounts, lower origination fees, or a lower interest rate. Finally, be prepared to walk away if the terms and rates offered are not satisfactory. Remember, negotiating for favorable mortgage rates can potentially save you thousands of dollars over the life of your loan.

Tools and Resources on Bankrate

Tools and Resources on Bankrate

Bankrate offers a variety of tools and resources to assist borrowers in making informed decisions about their mortgage rates. One valuable tool is the mortgage rate comparison tool, which allows users to compare rates from multiple lenders side by side. This tool provides an easy way to see which lenders are offering the best rates and terms. Additionally,

Bankrate provides expert advice on navigating mortgage rate options. Borrowers can access articles, guides, and FAQs that cover topics such as fixed-rate versus adjustable-rate mortgages, refinancing options, and understanding closing costs. These resources empower borrowers to confidently navigate the mortgage rate market and find the best mortgage rates for their individual needs.

Utilizing Bankrate's mortgage rate comparison tool

Utilizing Bankrate's mortgage rate comparison tool can help borrowers find the best mortgage rates available on the market. To use the tool, simply enter your loan details, such as loan amount, credit score, and ZIP code, and the tool will generate a list of lenders with their corresponding rates. From there,

you can compare the rates and terms offered by different lenders, making it easier to identify the most favorable options for your needs. This tool saves borrowers time and effort by eliminating the need to individually research and contact multiple lenders. Take advantage of this resource to stay informed and make smarter decisions when it comes to your mortgage rates.

Accessing expert advice on navigating mortgage rate options

When it comes to navigating mortgage rate options, accessing expert advice can be invaluable. Experts can provide guidance on understanding current market trends, evaluating different loan terms, and identifying the best mortgage rates for your specific financial situation. To access expert advice, consider reaching out to mortgage brokers, financial advisors, or loan officers who specialize in mortgages. These professionals can offer personalized insights and recommendations based on their expertise and industry knowledge.

Additionally, utilizing online resources such as forums, blogs, and educational websites can provide valuable information and tips for navigating mortgage rates effectively. By seeking expert advice, you can make informed decisions and increase your chances of securing the best mortgage rates available.

Conclusion

Conclusion

To stay ahead of the curve with the latest mortgage rates on Bankrate, it's crucial to actively monitor and analyze the trends in the market. By understanding the factors that impact mortgage rates, comparing different loan options, and utilizing the tools and resources available on Bankrate, you can make informed decisions and secure the best mortgage rates for your financial situation. Taking

advantage of expert advice and staying updated on current market trends will give you a competitive edge when navigating mortgage rate options. Remember, securing favorable mortgage rates can save you thousands of dollars over the life of your loan, so it's worth investing the time and effort to stay informed and make smart choices.

Key takeaways for staying ahead of the curve with the latest mortgage rates on Bankrate

- Regularly monitor mortgage rate trends on Bankrate to stay informed about changes in the market.

- Consider economic indicators and global events that may impact mortgage rates.

- Compare fixed-rate and adjustable-rate mortgage options to determine which aligns best with your financial goals.

- When shopping for mortgage rates, factor in your credit score, down payment, and loan term to secure the most favorable rates.

- Negotiate with lenders to get better rates and terms. Use your research and knowledge as leverage.

- Utilize the mortgage rate comparison tool on Bankrate to easily compare rates from different lenders.

- Take advantage of expert advice and resources on Bankrate to make informed decisions.

- Stay proactive and continuously track mortgage rate trends to take advantage of favorable opportunities.

- Explore refinancing options if rates have dropped significantly and it aligns with your financial goals.

- Remember that securing the best mortgage rates can save you thousands of dollars over the life of your loan.

FAQs related to understanding and tracking mortgage rates on Bankrate

FAQs related to understanding and tracking mortgage rates on Bankrate:

- How often do mortgage rates change on Bankrate?

- Can I get personalized mortgage rate quotes on Bankrate?

- What factors affect the mortgage rates displayed on Bankrate?

- How do I compare mortgage rates from different lenders on Bankrate?

- How can I lock in a mortgage rate on Bankrate?

- What is a good credit score to qualify for the best mortgage rates on Bankrate?

- How do I track mortgage rate trends over time on Bankrate?

- Can I refinance my mortgage to take advantage of lower rates on Bankrate?

- What other resources does Bankrate offer to help me understand mortgage rates?

- Are mortgage rates on Bankrate always up-to-date and reliable?